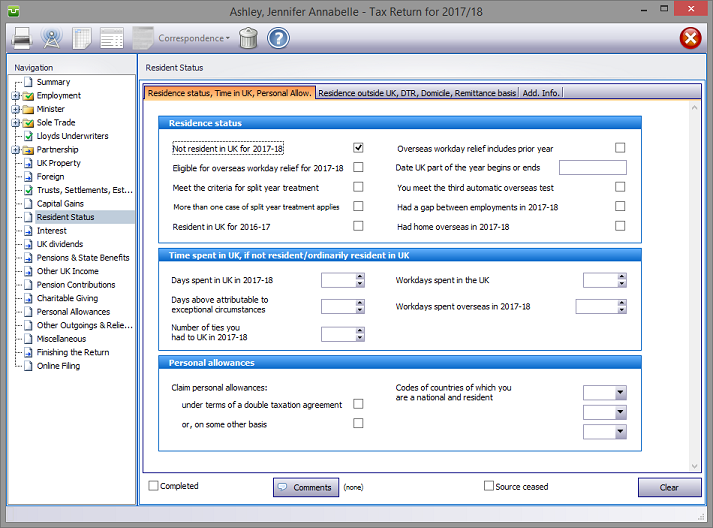

In the Navigation pane click on Resident Status

Please read the HMRC document sa109-notes.

Resident Status details

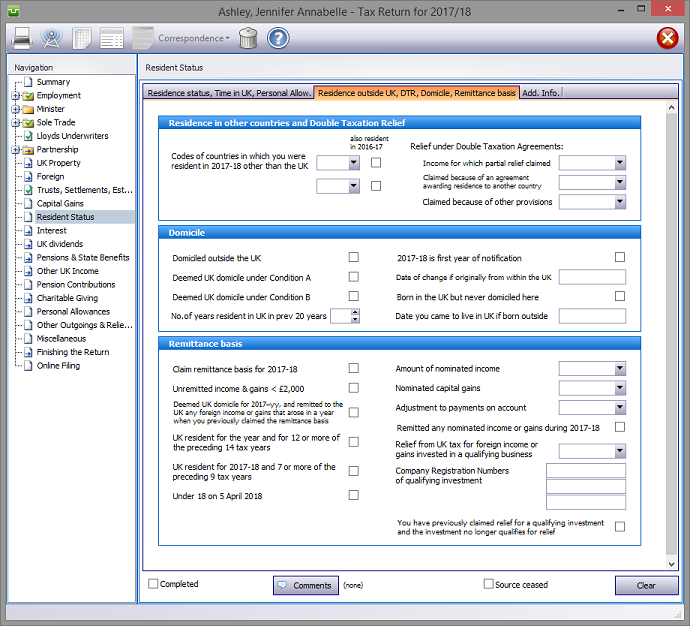

Residence status, Time in UK, Residence outside UK/DTR/Domicile/Remittance Basis

Click on the relevant tab and make the appropriate entries.

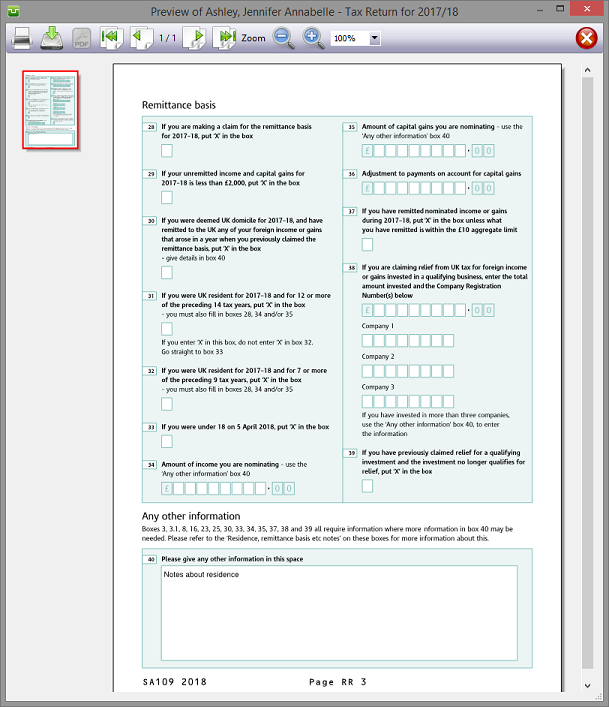

Entries made on the Additional Information tab will be printed in box 38 on pages RR3/4 of form sa109. Entries made via Comments are for information only and do not appear on the return or the supplementary pages. The first few words of comments appear to the right of the relevant boxes.

Finishing

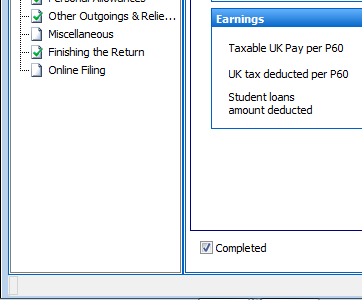

When no further entries are necessary check the Completed tick box in the lower left hand corner of the screen. Although doing this does not preclude further entries or amendments the online submission process will not proceed if there are unchecked boxes in sections containing data.

A small green tick in the relevant section on the left hand pane confirms that the Completion box is checked.

When it is no longer necessary to complete Resident Status pages finishes ensure that standing data is not carried forward to later years by checking the Source ceased tick box in the lower right of the screen.

| Notes | Helpsheets | ||||

| sa109-notes |

Residence, remittance basis etc. |

hs300 | Non-residents and investment income | hs303 | Non-resident entertainers and sportspersons |

| hs302 | Dual residents | hs304 | Non-residents relief under DTA's |

Copyright © 2025 Topup Software Limited All rights reserved.